The Budget 1O1 guides are intended to give an understanding of the San Francisco State University Budgeting System. Navigate the links to our guides below to learn more about San Francisco State's Budget.

Budget Basics

Let's start with a basic question: What is the University Budget? The Budget is the plan for where revenues adequate to run the University are forecast to come from and for how those funds should be allocated each year.

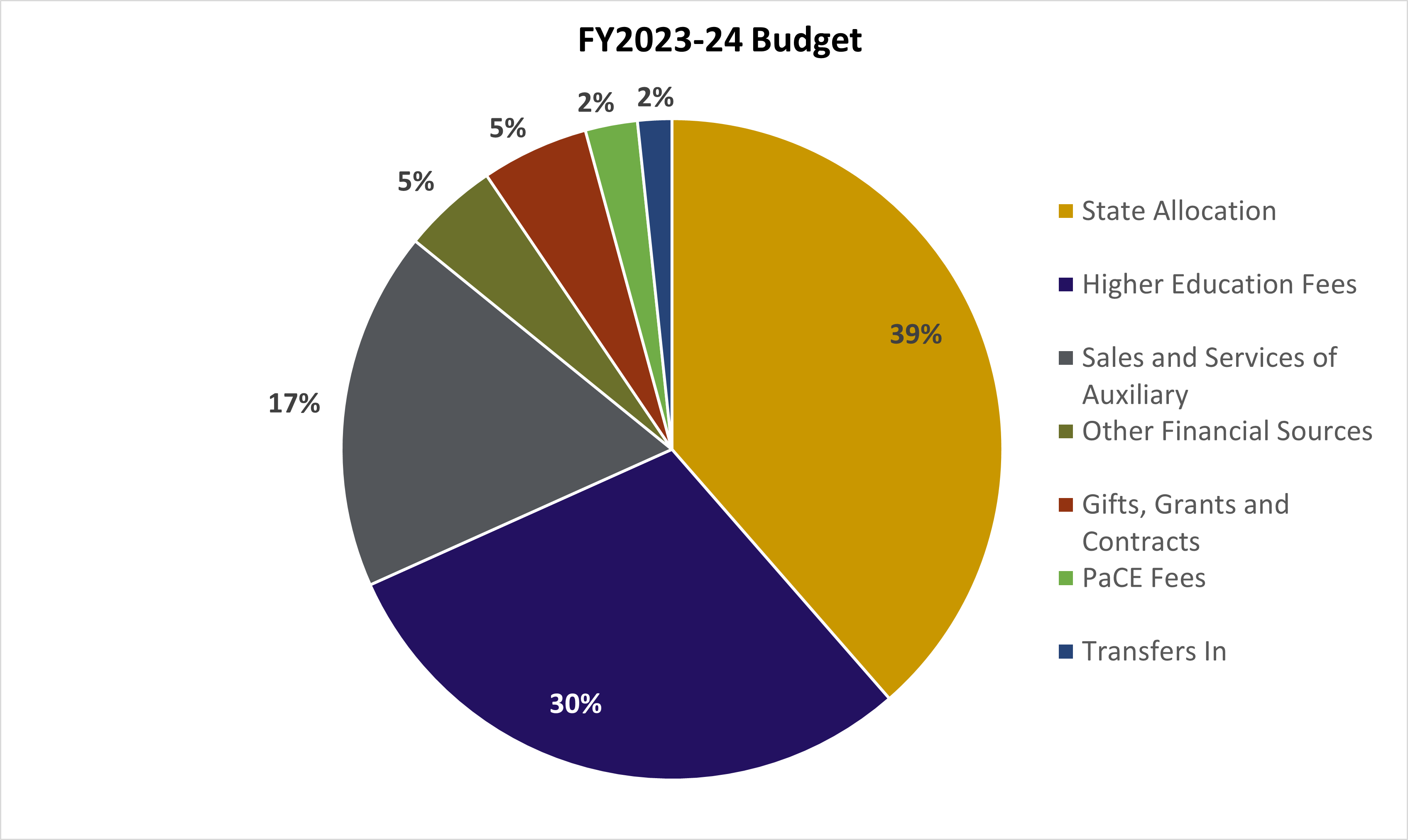

University Revenues

San Francisco State University’s revenues can be grouped into several major categories:

Higher Education Fees: The tuition and fees charged to enrolled students represent the campus’ largest source of revenue, approximately 41 percent of our total budget. The two main subsets of this revenue source are:

- Tuition revenue, which supports the university’s operating costs for instruction, operation and maintenance of plant, student services, student financial aid and institutional support;

- Campus mandatory fees and course fees, which provides funding for student materials and labs, student life, student services and other activities that provide extracurricular benefits for students, as well as capital improvements for student life facilities.

State Allocation: The University is a public institution, so it is supported to an extent by California taxpayers through an allocation from the state government. In the past, generous state support allowed San Francisco State to operate while keeping costs to students low.

Sales and services of auxiliaries: In addition to the tuition and fees charged for full-time degree programs, the University also generates revenue from educational activities such as workshops, seminars, conferences, library services, clinic medical services, career services and more. Auxiliary revenue comes from non-instructional support services including housing, food service, parking, bookstores, student centers and childcare centers.

Gifts, grants and contracts: This source of revenue includes funds that are awarded to units or individual faculty for federally sponsored research projects that align with the University’s mission. Federal contracts and grants come from agencies such as the National Institutes of Health or the National Science Foundation.

Aside from working with the federal government, the campus receives revenue from contracts and grants with state and local government as well as with private organizations.

This category also includes the private gifts given by donors for the benefit of SF State, as well as payouts from SF State’s endowments.

Professional and Continuing Education (PaCE) provides an increasingly broad spectrum of educational services to public and private agencies, as well as to a large number of persons who seek advanced educational training to help them increase their occupational competency. PaCE Funds are specifically restricted for the support and development of PaCE instructional programs. Costs of self-support instructional programs include support and improvement of the academic quality of the University.

Other sources: This category includes an assortment of revenue sources.

Transfers In: other supported programs by the chancellor’s office.

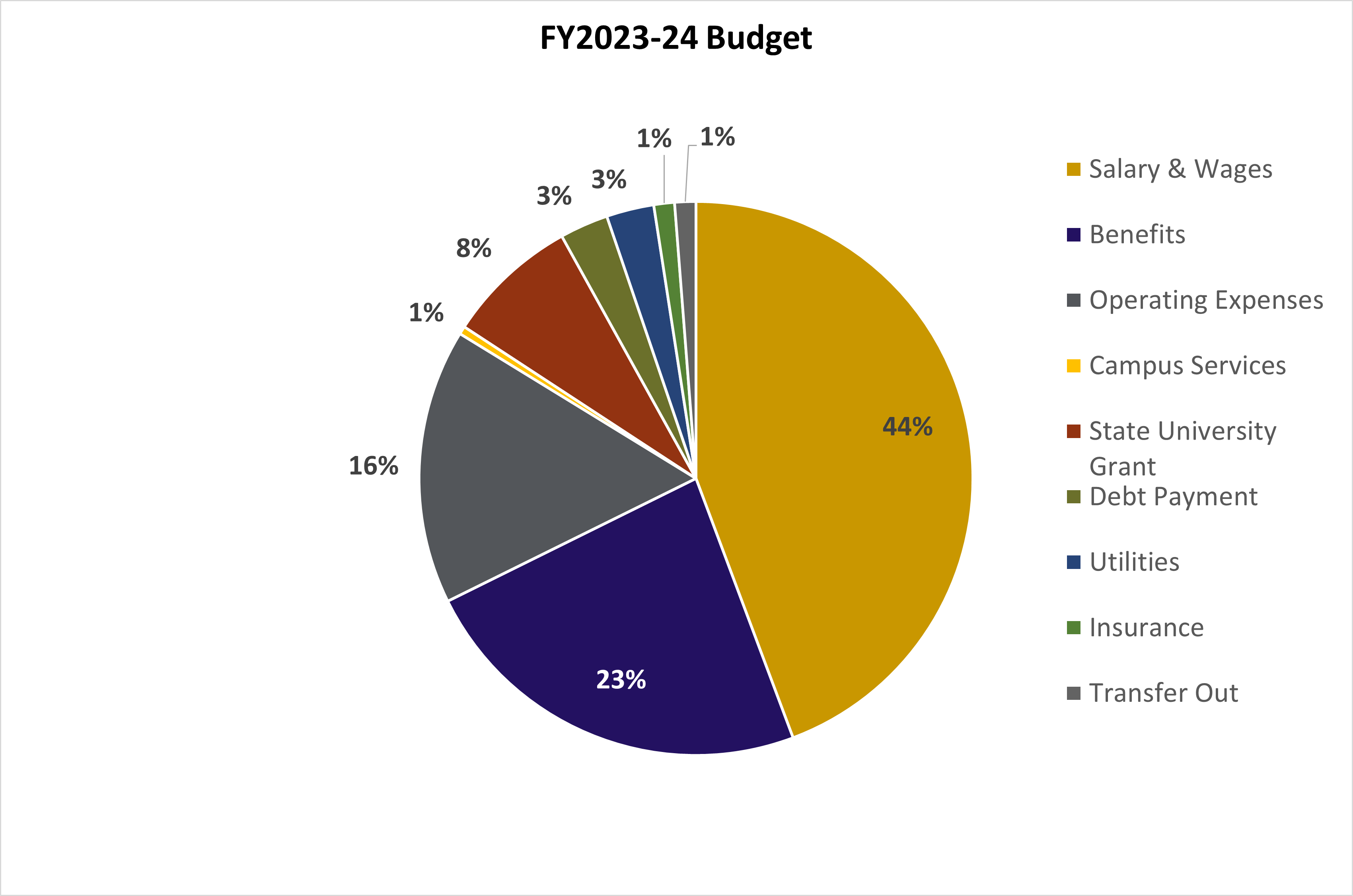

University Expenditures

SF State’s operating expenses can be grouped into several major categories:

Salaries and wages: The salaries and wages of faculty and staff constitute the campus’ largest expense category. SF State strives to offer compensation comparable to peer institutions so that we can recruit and retain the best instructors and staff to support the campus’ mission.

Benefits and retirement: Related to salaries and wages, the benefits that we provide to employees constitute the second-largest category of expenditures. Benefits and retirement is one of the lines in the budget over which we have very little control.

Student University Grant: This is SF State financial aid program that supplements other existing aid programs such as Pell Grant, Cal Grant, Middle-class scholarship.

Operating expenditures: This includes goods and services that are used in day-to-day campus operations, from laboratory materials to office supplies and from contractual services to business travel.

Debt Payments: This category of expenses includes the payments SF State makes on the loans it has taken out to fund past capital projects and other activities.

Campus Services: Includes costs for the services provided by the campus administrative units such as facilities, information technology, mail, copier program, etc.

Utilities: Similar to the utility bills a person pays at home, SF State pays for the energy and resource needs of the campus, including electricity, water, natural gas, waste disposal and more. Given the needs of labs and other energy-intensive facilities, these can be significant costs.

Insurance: Sometimes called the Risk Pool, this is the costs the University pays for insurance of property, auto, athletics program, workers compensation, industrial disability (IDI & IDL), travels and others.

Transfer out: transfers into capital and deferred maintenance programs.